Consumers see inflation – and spending – cooling off in the year ahead, New York Fed survey shows

The inflation burden has been decreasing as people expect to decrease their spending. According to a survey the New York federal reserve released on Monday.

The central bank’s district’s monthly Survey of consumers for December showed that the one-year inflation outlook declined to 5%, a low 0.2% from the month before and the lowest level since July 2021.

New York’s Fed’s one-year expectations had reached a record of 6.8% in June, according to data going back to 2013, amid an increase in inflation to its peak point in more than 40 years.

The numbers have changed, with a three-year outlook holding at 3% and five years higher than 2.4%.

As prices rose, people started spending less.

The one-year outlook for household spending fell to a percentage point up to 5.9%, the lowest since January 2022 and well below the record high, which was a 9% hit in May 2022.

At the same time, the expectation is for household income to rise by 4.6%.

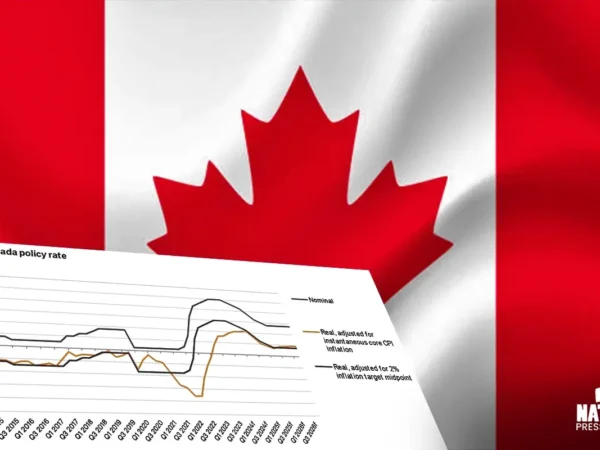

The results come. Interest rate rises to reduce inflation. In 2022 the central bank raised benchmark rates by 4.25% points and was speculated to add more increases in the early part of the year before pausing.

One primary target is the labor market, which grew 223,000 non-farm payroll jobs in December. Federal officials worry that an imbalance of labor would demand supply. On the other hand, there are 1.7 jobs for every available worker. So the wages and business will continue to go up.

Even after the efforts, survey respondents grew more positive about the labor market, with 40.8% expecting the joblessness to be higher a year from now, a 1.4% point decrease from November. In addition, joblessness was 3.5% in December, the lowest level since late 1969.

Home prices are also expected to grow 1.3%, a 0.3% point increase from Nov, according to Survey.