‘Fed is not your friend’: Wells Fargo delivers warning ahead of key inflation report

The fed reserve chair Jerome Powell would likely increase the interest rates and this could leave investors on the wrong side of the trade.

“You think about the history of the last 15 years. Whenever there was weakness, the Fed rode to the rescue. Not this time. The Fed cares about inflation, and that’s just about it,” the firm’s head of macro strategy said on Monday.

The department of labor would release the consumer price index in january which would reflect prices for goods and services

“Inflation could come off a fair bit. But we still don’t know exactly what the destination is,” said Schumacher.

Co-existence of the year’s early momentum is impossible with the Fed that’s very clear about battling inflation.

“Higher yields…doesn’t sound good to stocks,” Schumacher said, market optimism will eventually fade according to him.

In this year so far the tech-heavy Nasdaq increased almost 14% while S & P 500 increased about 8%.

Risks tied to the china spy balloon fallout and Russia tensions to create extra volatility are expected by Schumacher.

For relative safety and some upside, Schumacher still likes the 2-year treasury note. During the fast money interview in September 2022, he recommended it.

The note is not 4.5% which is an increase of 15% since the interview.

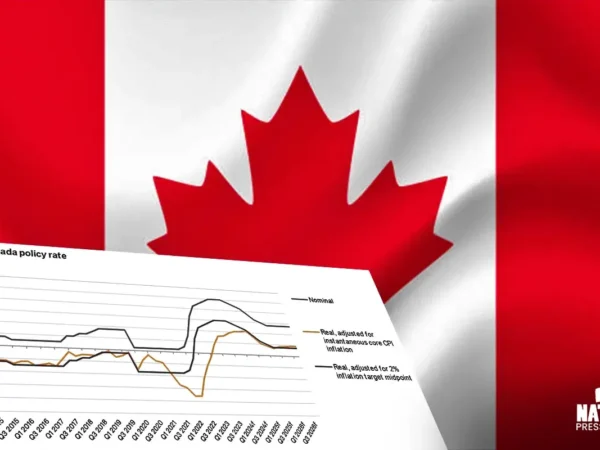

This year rate hikes will be seen for the next three quarters noticed by the latest forecast. So, higher yields should be supported. However, he notices that there is still a chance that Powell could shift course.

“Several folks in the committee lean fairly dovish,” he said. “If the economy does look a bit weaker, if the jobs picture does darken a fair bit, they may talk to jay Powell and say ‘look we cannot go along with additional rate hikes. We probably need a cut or two fairly soon.’ He may lose the argument soon.